🚀 Introducing FLIP: A Revolutionary NFT Liquidity Solution

Since the inception of NFTs, blockchain-based digital art issuance has garnered unprecedented attention. While NFTs once triggered an investment boom, the market now faces significant liquidity challenges.

The NFT liquidity shortage manifests in three key areas:

- 🌐 Cross-chain Limitations - EVM ecosystem lacks mature ERC-721 cross-chain solutions, limiting NFT circulation and use cases in rapidly growing L2 ecosystems

- 💸 Trading Inefficiency - Under traditional orderbook models, low-liquidity NFTs struggle with timely transactions, forcing holders to continuously lower prices, severely impacting asset value

- 🌱 Ecosystem Sustainability - Projects lack maintenance incentives after profiting from reserved NFTs, leading to quality decline and frequent rug pulls. Royalty disputes further affect ecosystem health.

Despite industry innovations like NFTX for NFT fractionalization, BendDAO for NFT lending, and Blur for NFT trading, these attempts haven't fundamentally solved the liquidity problem.

Against this backdrop, Flip emerges—a revolutionary NFT liquidity solution.

📈 Bonding Curve

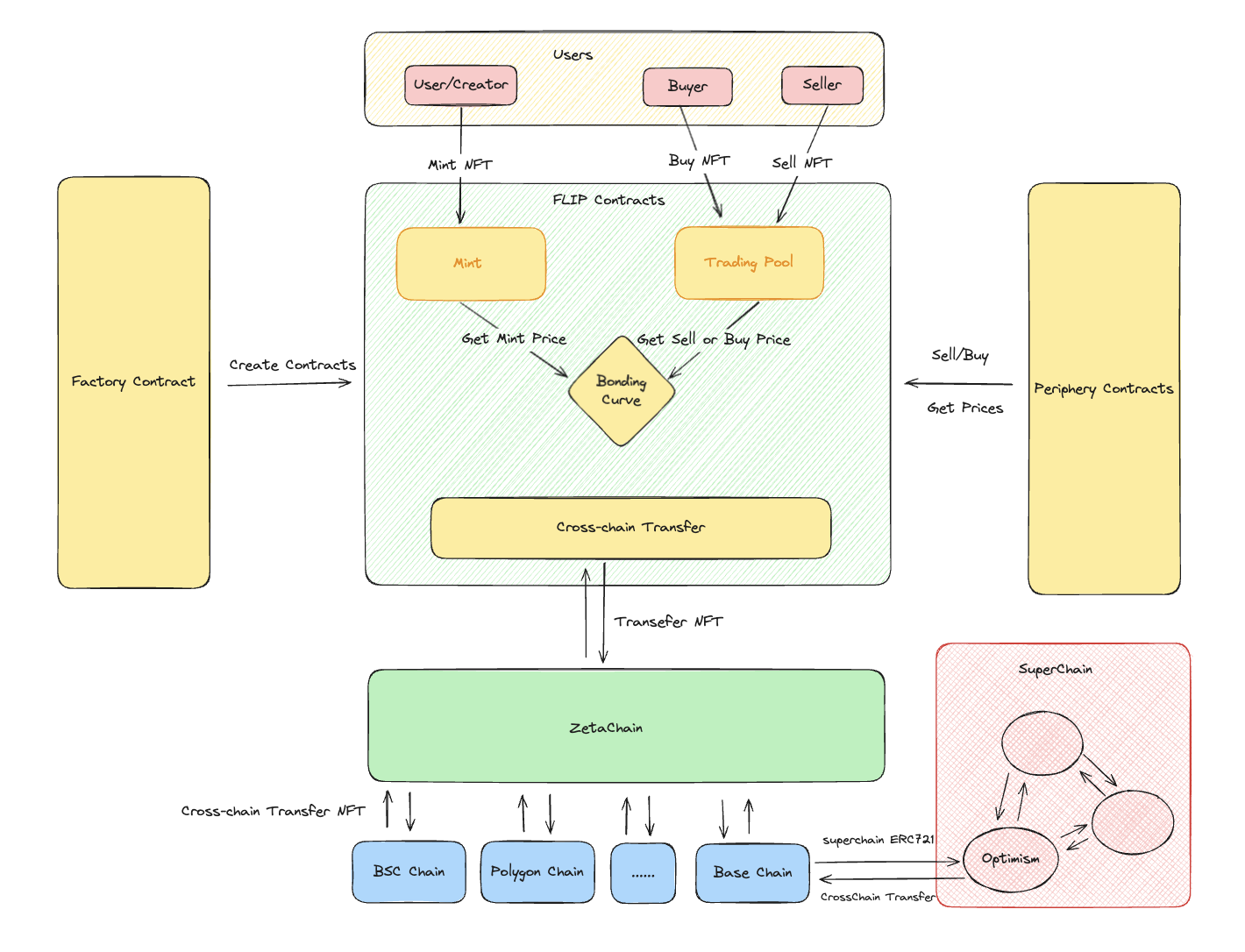

FLIP adopts an innovative ERC721-based standard, introducing the Bonding Curve algorithm for smart pricing. NFT minting prices start from a baseline, dynamically adjusting with mint volume until reaching preset limits. Project teams have no reserved rights and must participate in purchases equally with regular users. This ensures market-driven pricing while incentivizing creators to continuously add value through royalty mechanisms.

💦 Liquidity Mechanism

FLIP's other innovation lies in its instant liquidity mechanism. Users can trade NFTs directly through smart contracts anytime, with all sold NFTs entering a trading pool, eliminating traditional order placement processes. Buy and sell prices are intelligently determined by the Bonding Curve algorithm, significantly improving trading efficiency.

📖 Smart Contract

Through smart contract-based direct interactions, users need not rely on centralized trading platforms, enhancing liquidity while eliminating platform risks.

🌉 Cross Chain

Additionally, FLIP is integrating ZetaChain's cross-chain solution, currently supporting NFT cross-chain interactions between BSC, Base, and Polygon networks, with future expansion to more EVM-compatible chains planned. We are also advancing the Superchain ERC721 standard, and FLIP NFTs will support cross-chain interactions between Superchain networks in the future.

💻 Conclusion

In conclusion, FLIP addresses core NFT market pain points through three innovative mechanisms:

- 🔗 Cross-chain Interoperability - Breaking ecosystem silos, expanding use cases

- 💰 Smart Pricing - Bonding Curve mechanism ensures liquidity and price stability

- 🌱 Sustainable Incentives - Innovative mint and royalty mechanisms promote healthy ecosystem development

🤔 Why FLIP?

For Creators:

- Quick Launch:Launch an NFT project quickly through our platform

- Low Cost:The cost of starting a project is comparable to creating a pool on Uniswap

- No Delisting Risk:No need to worry about being delisted by centralized markets

For Traders:

- Fair Launch:Purchase at a low price during the project's early stage

- Buy/Sell Anytime:No worries about being unable to sell your NFT until it hits zero

- Fast Transactions:No need to wait for order matching

📜 Roadmap

- Phase 1 ✅ - Implement Bonding Curve NFT

- Phase 2 ✅ - Implement on-chain order book trading for NFTs

- Phase 3 ✅ - Implement self-custodial NFT DEX

- Phase 4 ✅- Implement NFT with cross-chain functionality